Business Owners

Barfield Wealth Management uses the Integrated Wealth Strategies model for business owners, entrepreneurs, small businesses, and corporate financial planning is designed to help them successfully sustain their wealth across multiple generations.

Managing a business demands meticulous planning and daily oversight, often leaving scarce room for personal financial planning. Our comprehensive Integrated Wealth Strategies approach ensures your personal finances are meticulously managed, allowing you to maximize the financial and tax advantages that come with business ownership.

Integrated Wealth Strategies

A Roadmap for Maximizing Your Financial Future Through Your Business

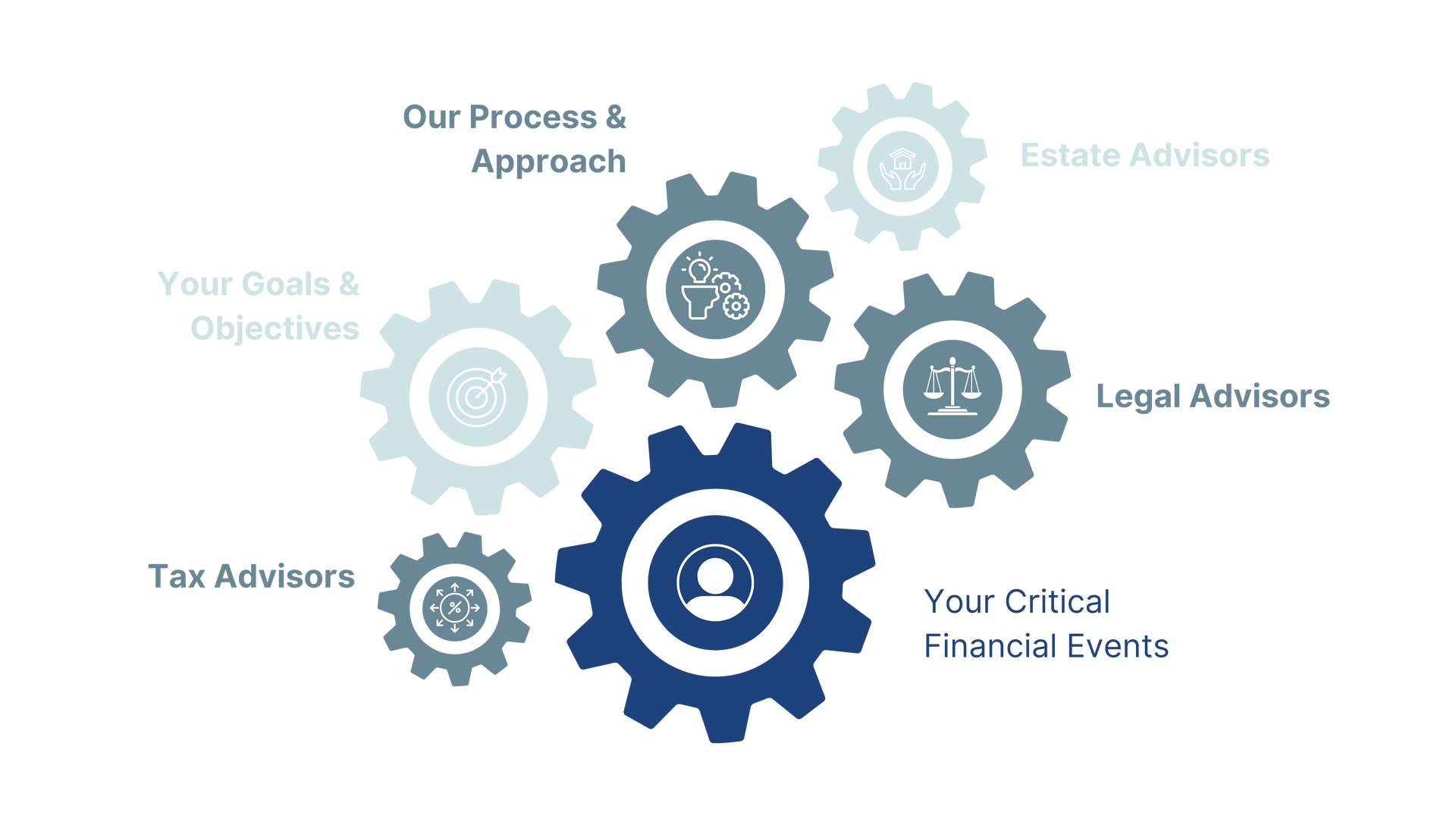

The Integrated Wealth Strategies model is designed to simplify the complexities of family finances, bring order and clarity to your financial plan, and create an orderly generational wealth transfer roadmap.

By leveraging our Integrated Wealth Strategies model our goal, in addition to providing you with someone you can trust and knows you, your family, and your business well, is to:

- Provide you with an increased ability to focus on your business

- Provide you with a solid financial plan that clearly outlines the steps and timelines required to achieve your short and long-term financial goals

- Provide you with a financial plan that maximizes your investment returns while staying within your risk parameters

- Provide you with detailed information on plan results as they relate to you achieving your financial goals

- Provide you with a family and business continuity plan.

- Provide you, if required, coordination with your other financial professionals which may include your accountant, attorney and banker.

Integrated Wealth Strategies

In analyzing your current financial situation, we employ Pareto Principle analysis techniques. This is a decision-making technique used to statistically separate the data entries into groups with the most or least effect on the data. It is commonly used in business to find the best strategies or problems to pursue.

The Pareto ratio provides us a rule of thumb, and we incorporate other analytical tools alongside Pareto analysis to justify the validity of our findings and to provide you with an optimal solution for your situation.

Ultimately, it optimizes the overall organization’s performance by coordinating the highest return activities to pursue.